Share

Finding Your Company's Supply Chain Heartbeat

Why Global Exporters Need a Supply Chain Digital Twin

At Bolster, we are building a better supply chain visibility model for importers and exporters, allowing them to get ahead of global bottlenecks. More than just “ships on a map”, a supply chain digital twin should reflect near real-time and fully featured data streams for the asset, as well as access to the tools and data required to continuously assess and understand the degree to which their supply chain dependencies are a business risk. Like weather forecasting, Bolster offers access to current supply chain conditions for Assets of Interest (AoI) (e.g. vessels, voyages, ports, insurers, vessel operators) in near real-time, thereby allowing for better forecasts. This data heartbeat is centred on a business’ critical assets in transit and ensures complete visibility over twins’ status and histories (e.g. delays, infringements, compliance violations) over the duration.

How will T&L Compliance Reporting Frameworks Drive Supply Chain Innovation?

Not unlike how Open Banking has disrupted Fintech over the past decade by giving consumers improved access to their data, sustainability compliance frameworks - like NetZero and EEIX for maritime emissions, reporting will become increasingly recognised and expected within Transportation & Logistics (T&L) functions of established companies with significant import/export activity. We see a future where businesses are driven to report better data more frequently, empowering consumers to vote with their dollars. Our SaaS-based Supply Chain Digital Twin product alleviates this T&L compliance challenge by allowing customers to more effectively emulate AoIs in a digital space, along with relevant metrics streams (e.g. inventory, working capital, emissions, etc.), resulting in better reporting and more informed decisions.

How Does One “SMAQ?”

First, a bit of primer on some of the ways that a user might interact with what we call a “SMAQ Digital Twin.”

A user subscribes to a data feed for their goods in transit (e.g. the duration of a container’s voyage). For exporters, this can be a ship name provided by your freight forwarder or a BoL (Bill of Lading) number corresponding to the container(s) themselves. Imagine a list of objects to which a user may ‘subscribe.’

Users are pushed actionable insights (e.g. delays, citations, ESG risk, etc.) per their rules and preferences (email, SMS, webhook, etc.) as they occur so that they have full visibility of their goods in transit with as little time cost as possible. Imagine push notifications only when you want them.

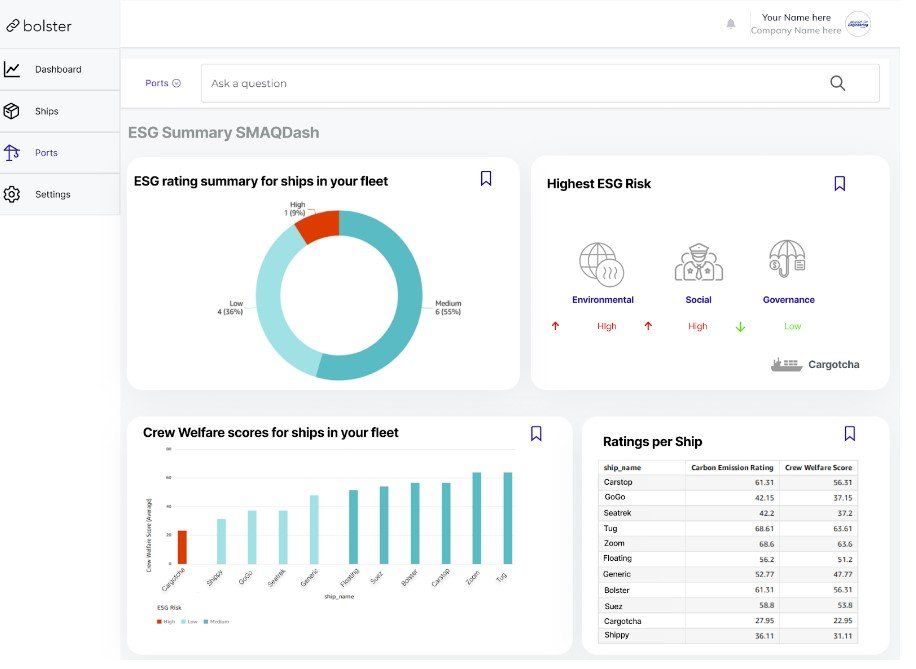

Retrospective analyses are supported through Bolster’s analytics for delay, cost, and ESG drill downs, with a usage-based pricing model. See the dashboard above or other materials available on our website. This is a fully cloud-native, event-driven, serverless, microservices-oriented LakeHouse architecture that you get for free.

SaaS data streams, dashboards, and notifications allow each user to interact with data and data products with maximum flexibility. Imagine a simple, unified management interface for all of your data streams (e.g. ships, trains, vehicles, containers, trucks, etc.), and you have the power of the SMAQ stack.

How is Bolster’s Model Different?

Although data with varying degrees of timeliness, breadth, and resolution are available for AoIs like fleet vessels/vehicles, these models are nearly impossible to interoperate, drastically reducing their potential value. Our system is built to apply a focused lens to specifically relevant aspects of fleet/asset performance and interactions. Depending on user demands, it is easily and quickly extendable to new datasets and interfaces.

We were inspired to write this blog post by an excellent report produced by New Zealand’s MBIE, which has provided some great ideas for how ESG metrics will become part of how we do business with global markets. We think that better access to timely data allows consumers and corporations to make investments more aligned with their values and that transparency is key.

As part of Bolster’s ongoing work in supply chain visibility, we are developing real-time models of how assets like containers, ships, and trucks behave and interact with each other. You can think of this as creating a digital twin of critical components of your supply chain, allowing for improved asset performance, hypotheses testing, and business process automation. Since we are already collecting a wide range of streaming data for this purpose, adding data streams that may inform ESG metrics is a natural extension of our work.

Our platform is powered by a combination of Vessel Telemetry, weather/traffic sensing, and a range of other streaming and static data sources (e.g. conflict). The product is a model based on the given AoI, to which other factors may be integrated - in real-time. The applications of this supply chain model are broad and include the utility for fishing, shipping, defence, and law enforcement, among many others. Having accurate and timely models of critical assets composing each business’s supply chain will become increasingly important.

What we need from our Supporters

To extend our model to include ESG metrics, we first needed to find ways to work backwards from the factors of interest (e.g. CO2 emissions), source corresponding data streams, and operationalise those streams in real-time. This exercise consists of knitting together dozens of datasets under a common object model (SMAQ) such that they may cooperate in the same conceptual space. Through an iterative process of deriving data in real-time (e.g. engine performance + vessel dimensions + engine status = emissions factor), and UI prototyping (e.g. dashboards, widgets, webhooks, CSV, etc.), we can render higher breadth, depth, and timeliness of context.

We have identified a number of static and dynamic data sources that could power various ESG-related metrics across the spectrum, including greenhouse gas emissions, historical polluting activity, and labour abuse incidents. However, before we lean into bringing these metrics into our twin model, we wanted to hear more about our potential customers’ priorities for ESG reporting in the T&L domain.

The nature of compliance and ESG reporting is changing, especially in transportation and logistics (T&L), where things like the EEXI (Energy Efficiency Existing Ship Index) regime are driving demand for improved metrics reporting.

If your company exports or imports things on ships (bulk goods, timber, containers, petroleum, etc.), and you don’t have a grip on your supply chain and its associated risks, we should talk. Please reach out for a demo of the SMAQ Platform.

New Paragraph

Share: