Share

Discovering Supply Chain Visibility

Bolster started its journey in national security analytics, but after decades of experience implementing analytics and tech in government, we made the deliberate decision to apply our freshly developed SMAQ (Structured Model for Analytical Questioning) Platform against the hardest problem we could find: Supply Chain Visibility.

At first glance, we naively saw the challenge of "improving supply chain visibility" as simply the movement of goods (containers) from A to B, but we quickly realised that the physical movement of goods was only one of the highest level indicators for supply chain performance.

Once we had operationalised the movement of whole ships from A to B, including the forecasting thereof, we sought to broaden the width of our visibility model by incorporating container terminal movement data (RFID) and then ground transport telematics into the model.

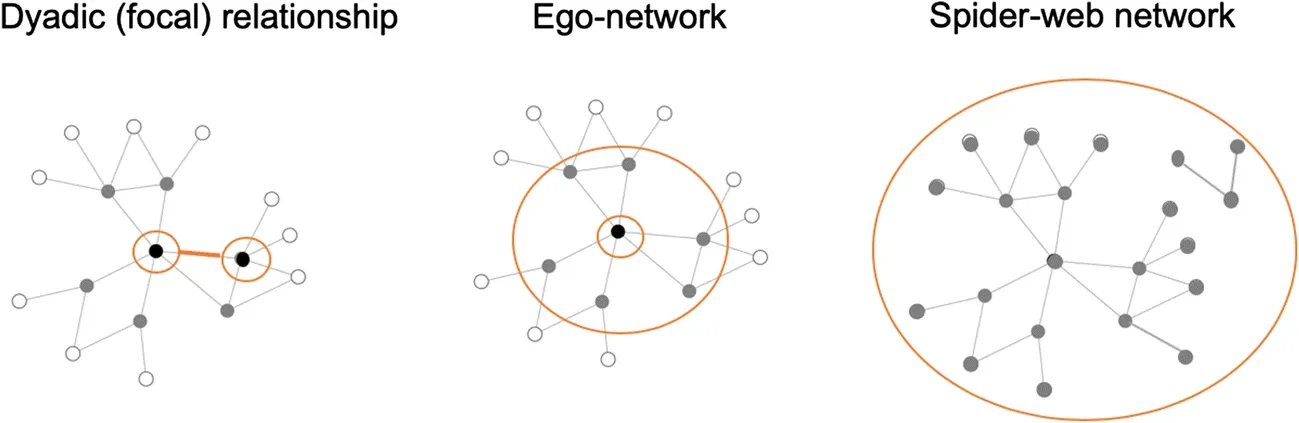

Only at this point in our SMAQ: Supply Chain application journey did the more subtly nuanced complexity and value of supplier relationship modelling become apparent. For the Big Fours of the world, these supplier-consumer relationship models were the most pressing gap in terms of visibility within supply chains. This is due to the cascading and opaque nature of shortages across individual "nodes" in the chain, which eventually lead to reduced shipping throughput, as displayed via our freight visibility models.

Although graph/network/link analysis methodologies are a speciality of Bolster, the challenge of supplier relationship modelling was unlike freight in that obtaining data sources for explicit supplier relationship modelling is challenging at best. In our opinion, this is generally due to a misguided culture of data hoarding borne from a fundamental distrust of technology by many executives, which results in underleveraged data assets.

The situation is symptomatic of a broader inability for enterprise to effectively marshall it's data assets for increased revenue and improved access to insight. However, previously the costs, risks, and practicalities of sharing supplier data between companies of all sizes were prohibitive and gave executives a much-needed fig leaf. Despite broad consensus around the supplier relationship visibility gap, the Cost to Serve (CTS), value proposition, and risks of failure didn't stack up.

Several things have changed in the last five years that should/will alter the above calculus in favour of leveraging enterprise data to achieve business outcomes.

- Cloud has fundamentally changed our ability to elastically and cheaply scale

- Serverless Compute has made Cost to Serve (CTS) very low

- Eventing has improved potential for secure data sharing and transparent collaboration

- Covid exposed the fragility and opacity of our globalised supply chains

- Conflict in Ukraine has reaffirmed the potential for global geopolitical disruptions

In the future, the combination of a low CTS, continued global instability, and options for transparent collaboration will tip the scales in favour of data sharing.

Bolster's SMAQ Platform is designed specifically around the above and is ideally suited for leveraging your data for improved revenues or access to insight. In the case of supplier relationship data, insight would likely come in the form of improved 2nd, 3rd, and 4th order visibility over supplier dependencies, based on data obfusticated and securely shared through ERP/accounting integrations.

In exchange for access to supplier transaction data, users are given the ability to more effectively understand and leverage their data to gain visibility over their supplier dependencies, contribute to new revenues (monetised APIs), and/or [coursely] benchmark their organisation.

SMAQ's unique combination of event-oriented analytics with hyper granular data access controls and logging make it the ideal platform through which suppliers may gain transparent leverage over one aspect of their data resources and translate that leverage into direct business outcomes (alerting, dashboards, forecasting, etc.) that "make the ship go faster."

We may have built our SMAQ Supply Chain application on top of literal vessel/port telemetry streams, but we still appreciate the degree to which moving farther up the decision chain (e.g. transaction-level automated modelling via accounting APIs) is a potential next step in terms of understanding supply-side risk, i.e. gaining improved visibility over your Spider-web supplier network.

It is our hope at Bolster that, in addition to the spatially oriented transportation and logistics SMAQ integrations already supported (freight, weather, traffic, conflict, piracy, etc.), providing a secure and cost-effective mechanism for monetising, sharing and analysing "supply-side" enterprise data, in a competitive business environment, we can accelerate the move toward nuanced supplier relational analytics.

This overlay of relational, temporal, and geospatial data dimensions in quick time and how resultant products support decision advantage, regardless of how it is disseminated (e.g. dashboards, SMS, email, chat, voice, blinking lights, etc.), how frequently it is updated (e.g. every second, every minute, every month), and/or how it may be shared (audit, access controls, usage show back analytics, etc.), is a Bolster speciality - have no fear.

If you appreciated the maritime pun, move things on ships, and/or are interested in better understanding your supply-side dependencies using data you probably already have!

(All modern accounting applications will have suitable APIs for integration)

Please reach out to talk about how you could be more actively leveraging it with Bolster.

Share: